Bonhoeffer Flops: Christian Businesses Need a Love for Authenticity and a Knack for Honest Marketing

In today’s newsletter:

- “Bonhoeffer Flops: Christian Businesses Need a Love for Authenticity and a Knack for Honest Marketing

- A.I. Will Be Home for Christmas, Market Watch, and Amazon Sells Cars

- Tulipmania – Beware of Quickly Rising (and Falling) Assets

Faith-based movie studio and distributor Angel Studios bet big on releasing a biopic about German theologian Dietrich Bonhoeffer last month, and more than a few things went wrong:

– There has been very intentional distancing between the director of the movie, Todd Komarnicki, and the author of the book many people associate with this film, Eric Metaxas.

– Bonhoeffer’s living relatives issued an open letter condemning the film’s historical inaccuracy and deliberately untruthful portrayal of Dietrich Bonhoeffer.

– Eric Metaxas publicly called all of Bonhoeffer’s family members unhinged, Hamas-loving Jew-haters, based on, apparently, no evidence, and he constantly tied Bonhoeffer to his own political and theological inclinations.

– Bonhoeffer’s living relatives, descendants of people who gave their lives to protect the Jews and resist Hitler in WWII, are suing Metaxas for defamation.

– Scholars wrote articles to report that the portrayal of Bonhoeffer in this recent movie is inaccurate.

– Angel Studios chose to release Bonhoeffer on the same day as Wicked and Gladiator 2, and its second weekend was up against Disney’s Moana 2 during Thanksgiving week.

– Some critics say it was a bad movie.

But other than that, everything went great.

Gallows humor aside, this is a film that looks to have done less than $12 million at the box office as of last week, against a budget of $25 million, and an additional P&A budget of at least $5 million (and probably 4-5 times that). And keep in mind – Angel Studios doesn’t keep all of that $12 million either, as (at minimum) the theaters will take a sizeable chunk of the take. This comes at a time when Angel Studios is trying to go public, pitching a valuation of $2 billion – a rough sell for a company that has recently lost its association with hit TV series The Chosen and has thus far been unable to recreate the financial success of Sound of Freedom – a film they did not produce but did distribute. What’s more – the $12 million figure may be greatly inflated, because Angel Studio’s “Guild Members” get 2 free movie tickets, and their “pay it forward” model of encouraging moviegoers to pay for others to go see a screening could skew the data.

It’s difficult to know all of the financial arrangements, as Angel Studios acquired this film and did not produce it entirely. But they did certainly spend quite a bit of money on it. To put it simply:

Angel Studios needed this to go well. It did not go well.

To make matters worse, the marketing material was, at times, downright goofy. Dietrich Bonhoeffer was a quiet, deeply intellectual theologian in Germany who was born a hundred years ago. His primary interests, at the time of his writing of seminal works such as The Cost of Discipleship and Life Together were the Sermon on the Mount, training pastors, and convincing the German church to stop allowing the government so much power in its doctrine and teachings. In an incredibly brave moment, he did, in fact, pass information once or twice to a British clergyman in connection with a plot against Hitler. This was done at the insistence of his family, and he decided to play messenger when it was asked of him on those occasions. Bonhoeffer was indeed a brave man who could preach an unpopular truth and who did, in his way, resist Hitler. But his primary concern was working out theology, ecclesiology, and figuring out how Christians ought to live in peace and charity.

Angel Studios’ promotional material not only glossed over so much of the real character of the man behind the movie, they chose the tagline “Pastor, Spy, Assassin.” Bonhoeffer was indeed a pastor. Calling him a “spy” is true in the technical sense, but it does seem to be stretching the truth, or at least exaggerating. Calling him an assassin is just flat-out untrue.

Nevertheless, in Angel Studios’ initial promos, they had Dietrich Bonhoeffer wearing a suicide bomber’s vest under a trench coat, outside of a Nazi building.

This image was apparently scrubbed from the internet by Angel, upon receiving immediate ridicule, but we saved the image for the sake of this article.

Their updated poster wasn’t much better. They replaced the suicide bomber’s vest with a gun in the hands of a shifty-eyed Bonhoeffer walking down the streets of Germany.

This, in short, did not happen. Bonhoeffer was an avowed pacifist.

It all seems to be a very conscious and deliberate attempt to paint Dietrich Bonhoeffer as something that he objectively was not. He was not a hired gun, an assassin, an advocate of political violence, or a scheming hitman, as exciting as those things may seem.

He ran a school for pastors. He preached in Lutheran Churches. He held some views that evangelicals would agree with, and others they would passionately disagree with.

Even a cursory look at the source material would make it very clear to the makers of this film that depicting Bonhoeffer with a gun as he sneaks through the streets is wildly misleading (to say nothing of the suicide bombing vest…). And ultimately, I think that’s what was this film’s undoing.

Angel Studios – an explicitly faith-based organization – doesn’t always seem to care much about the truth.

Lessons for Christian Business Owners

No one likes to be “sold a bill of goods.” No one wants to be lied to, exaggerated to, or to feel like they were let down on a promise. When you throw the name of God into the mix, however, this is all doubly true. Metaxas’ book Boenhoffer was a New York Times bestseller not that many years ago, and a reasonable portion of the target audience likely read the book – which meant that they knew the whole “assassin” thing was purposely misleading.

Authenticity has always mattered, but in terms of dollars and cents, it might matter now more than ever.

Additionally, the methods of reaching their target audience seem to have fallen flat as well. This is anecdotal, but according to the S2W readers that we surveyed, people were unaware that the film even existed. One in particular, a reader in Southern California, is a big fan of Dietrich Bonhoeffer, and had this to say:

“It’s interesting I wasn’t marketed that movie at all. I get all the normal Christian media I think…”

We’re left with two key takeaways:

1) Authenticity matters. Telling the truth matters. Purposefully misrepresenting someone apparently ends up in lawsuits and embarrassingly public fights. This kind of thing turns people off from fandom.

2) Despite all of our analytics, social media, and data mining… In some ways, it’s getting harder for small to mid-sized companies to be sure that they’re reaching their target audience. It takes good marketing, wise media buying choices, and prudent timing to allow your product to make a splash in this busy, distracted economy. This seems like a good time to remind our readers that Fidelitas is the top-notch agency that produces this newsletter.

Bonhoeffer is shaping up to be a box office bomb. Maybe Angel Studios is able to find great success with upcoming films, or leverage their past revenue into a successful run in selling shares of their company. But companies of this size can’t survive too many Bonhoeffers. For the wise business owner, take a lesson on the disastrous PR and marketing from this film, and make sure your messaging is hitting the target before you roll it out en masse.

For what it’s worth, we did go and see the movie. This isn’t really the sort of publication to do an in-depth movie review, but it seems appropriate to say that much about the movie was fine, even good. The production value was good, the music was good, and the acting was mostly good as well. The editing was not good, and some of the dialogue was clunky. The film itself did have some historical issues, but it was not nearly as unhinged as the marketing for the film was. At the end of the day, however, this movie didn’t seem to have a lock on what the underlying story was supposed to be. It trafficked in hype, short-lived emotions, and clever thematic ploys while gravely neglecting the fundamentals of storytelling.

And neglecting the fundamentals doesn’t usually work out in business, either.

Fun Fact

(In Partnership with Fidelitas)

Did you know the brains behind Sent To Win run a full-service marketing and PR agency? If you need help scaling your business profitably, you need to connect with Fidelitas.

Fidelitas has been helping small businesses, churches, non-profits, publicly traded companies, and even professional sports teams win for over 16 years. Fidelitas leads by serving as a Strategic Partner and prides itself on producing measurable results for its clients.

Check them out here or email Tyler@Fidelitas.co to connect directly with the CEO.

INDUSTRY INSIGHTS

A.I. Will Be Home for Christmas, Market Watch, and Amazon Sells Cars

A.I. Will Be Home for Christmas

Last week, Apple released its long-awaited software upgrade 18.2 which integrates Siri with OpenAI’s ChatGPT for all Apple users who download the update. This is a big win for Open AI, who is often plagued with questions for how they are going to sustainably monetize their products, which have cost an astronomical sum to develop and run. It’s also potentially a big win for Apple, to reinvigorate their brand and be the preeminent, customer-facing company that offers a wide swath of AI-integrated products, in a season where there isn’t really a must-have AI gadget for consumers just yet.

In response to these new rollouts, Apple’s stock has climbed even more, extending an already legendary rally. Still, some say that Google is better positioned to win the AI arms race in the market with their AI assistant Gemini, and Microsoft has plans of its own. Time will tell who captures the biggest piece of this potentially massive pie – though some have cautioned that the explosive rate of advancement in AI technology may have already slowed drastically.

Market Watch

The Dow Jones dropped more than 200 points, in its first 9-day losing streak since the 1970s. The S&P 500 and NASDAQ also posted losses recently. Nvidia continues to run in correction territory, despite a strong performance from the company, likely correcting an extremely high P/E.

Inflation was up in November’s CPI report, at a 0.3% increase on a seasonally-adjusted basis, bringing the twelve-month inflation to 2.7%, still higher than the target. Despite this bump in inflation, investors still expect a quarter-point rate cut from the Fed today. Despite the outlook for a cut, some investors worry that cutting rates during an increase in inflation is not the right move for the macroeconomy.

Gold continues to perform very strongly, amid rate cuts in the U.S. and Chinese gold-buying.

Oil prices have dipped ahead of the Fed meeting, and the average 30-year-fixed mortgage rate has held fairly steady at around 6.79%.

Amazon Sells Cars

Ever searching for new industries to enter, Amazon now sells vehicles through their website. To begin, they are selling Hyundai, but they plan to sell additional brands as well. Amazon Auto is already available in 48 states, though availability depends on how far you are willing to drive to pick up your new car – they aren’t putting these things on Amazon delivery trucks, at least not for now.

Some outlets say this isn’t too much of an upset in the industry just yet, and some experts are still encouraging investors to put their faith in companies like Carvana. Others call this a “major disruption” and foresee a future where Amazon dominates the car-buying online channels.

Amazon, as a whole, continues a strong growth trajectory in revenue, pulling in $620 billion from September 23 to September 24. Time will tell how the fight for online car sales shakes out, but one thing is for sure: Amazon has money to burn.

Sunday School

Q. What passage of scripture is often read on Christmas morning?

A. Luke 2.

TIPS & TRICKS

Tulipmania – Beware of Quickly Rising (and Falling) Assets

Everyone wants to pick a winning investment, that once-in-a-generation winner that explodes in value and never looks back. We look back on Apple’s jaw-dropping growth from the early 2000s until today and see how much money those lucky (or wise) investors made who invested at the right time. More recently, we see winners like Nvidia, which has seen a meteoric rise over the last few years, going from less than a dollar per share to $140 very quickly. Today, Nvidia’s market cap is around $3.3 trillion.

But even with high P/Es and a healthy dose of speculation, an Apple or an Nvidia still have some fundamentals behind them. They actually bring in a significant amount of revenue, they have stable leadership, and the market is poised for them to grow well into the future.

With exciting, dynamic, fast-growing investments, it can sometimes be tempting to forget about the fundamentals altogether and only chase the growth.

But explosive growth can be a double-edged sword.

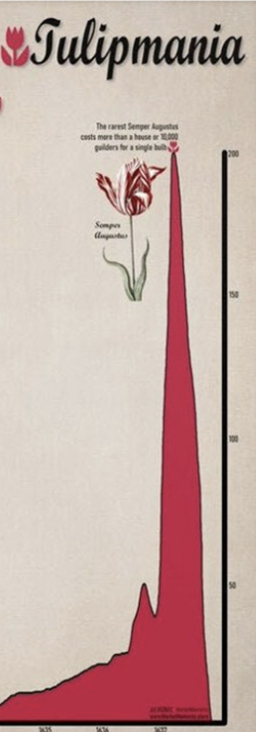

There is a phenomenon in free markets called “Tulipmania” that we want to highlight today, just to add some caution when you are considering investing big in unusually fast-growing speculative assets – especially less-than-reputable stocks or crypto tokens.

Tulips?

In the 1600s, exotic tulips became a popular way of showing wealth in Amsterdam. It started small, but before long, a few tulips could be traded for real estate, you could swap the right kind of tulip bulb for a waterfront mansion, and in 1636, one particular kind of tulip bulb was going for 150x a craftsman’s salary.

For one flower bulb. People didn’t even plant them, at a certain point. They just traded the bulbs. Prices went up drastically on raw enthusiasm. Eventually, the middle and lower classes even got involved and started risking their assets on trading bulbs. The people sort of collectively realized how ridiculously overvalued these flowers were suddenly, and the market crashed quickly, creating a miniature financial crisis and ruining many people. It was a speculative bubble that burst in a spectacular way.

The eerie thing is, the growth curves between tulips in the 1600s and some of our fast-growing investments today look very similar. Here’s a representation of the tulip market back then:

Source: https://x.com/theoscarhoole/status/1863602566753341816

Now take a look at the growth curves for a modern meme coin. This is DOGE:

Looks amazing! $1,000 invested in Doge in the beginning of 2021 would have been worth something like $2 million just a couple of months later. However, here’s the rest of the chart:

The joyride didn’t last too long, and a lot of people lost a lot of money. It’s up again (sharply) of late because of its association with Elon Musk and the new “Department Of Government Efficiency” (D.O.G.E.). But this is driven by nothing other than name recognition, top-of-mind awareness, and greater fool theory. It will likely crash again.

There are no fundamentals in tulips or meme coins, even if the odd investor makes a killing. And keep in mind, this is steelmanning the argument. If we were to look at rug-pulls and collapsed tokens like Celsius, Sharpei, or (Lord help us) the Hawk Tuah Meme Coin, the devaluation cliff looks far worse, even though these investments were briefly shooting upward at lightning speed.

Or take the dot com bubble of a couple of decades ago – hyper-speculation on fast-growing stocks drove massive (and short-lived) gains for numerous companies that soon crashed, declared bankruptcy, or ceased to exist. Pure enthusiasm was driving prices, in a sort of mass hysteria that the market quickly corrected. Take Akamai Technologies for example:

Akamai is one of the lucky few dot-com-bubble stocks to still be around today, but even still it has taken 25 years for Akamai to recover less than ⅓ of its peak value. If you invested in the hype in 1999, you would have lost everything. It was peak Tulipmania.

Here’s the lesson: Don’t invest what you can’t afford to lose, have a healthy suspicion of sudden and overwhelming public support for an investment, and always remember that things which climb quickly tend to fall just as fast, and sometimes faster.

Growth investing is having its moment in the market, but there is a reason that Warren Buffett and his long-term strategy of value investing is so durable. Sometimes the lights that shine the brightest overheat and explode.

Sent to Win is for entertainment purposes only and should not be construed as financial advice. Sent to Win does not give financial advice. Sent to Win recommends that individuals always see a certified investing professional before making decisions on how to invest in the market.

Jakob would later come to regret trading his house for the tulip.

Quick Hits

- Greek “ghost towns” offer an eerie example of population collapse in Western countries, with dire economic consequences.

- A Washington pastor is sued for promoting a $6 million crypto Ponzi scheme to his congregation.

- Super sports agent Scott Boras secured the largest MLB contract of all time for his client Juan Soto.

- The Daystar saga continues: Jonathan and Suzie Lamb reveal evidence that the ministry had them followed, tracked, and rummaged through their things.

- Embattled Christian baker Jack Phillips, whose business has repeatedly been targeted by activists bringing lawsuits, emerges victorious yet again in a big win for religious liberty in the U.S.A.

Our “Bonhoeffer Flops” graphic was generated using AI prompts. Guess the prompt for your chance to win Sent To Win gear. Just reply to this email with your best guess.

For Kingdom Leaders, By Kingdom Leaders

Bringing Kingdom-minded leaders like you fresh perspectives and insights on business, finance, and leadership trends.