Angel Investors? Christian Media Powerhouse Calls All Hands in Latest Round of Fundraising

In today’s newsletter:

- Angel Investors? Christian Media Powerhouse Calls All Hands in Latest Round of Fundraising

- Football Season, Market Watch, and Christian Orgs Sue IRS

- How to Build an Advisory Board

If you put your money in a savings account, you’re going to get less than half of one percent APY. Even if there was no such thing as inflation, that would still be laughable. As is, you’re losing quite a bit of money if you park a lot of cash there.

If you put your money into a high-yield online-only bank, you can do a bit better – 4 or 5%, say. This money can often be liquid, so it’s not a terrible place to hold some cash while you wait… But your money isn’t doing a whole lot of work for you there, even if it isn’t dying to inflation.

If you put your money in the stock market, it can be highly risky, depending on how you invest, but with a properly diversified portfolio or mutual fund, you can reliably make an annualized 11 or 12%.

Not bad. But there is an industry that offers its investors a 20% preferred return:

The movie business.

Yes, there is still a very real risk here, but the risk isn’t as great as you might think. Big box office bombs grab the headlines for how much money they lose, but professional powerbrokers and financiers are savvier than we like to give them credit for, no matter how bad a major studio’s showing might be. Completion bonds, performance bonds, and other forms of insurance make it difficult to lose your shorts investing in a major motion picture from one of the big studios.

The problem? Paramount isn’t taking your calls right now, and Sony only wants your money if you are buying a ticket. No matter how much you’d like to invest in the next Marvel movie, you simply can’t.

But one faith-based studio and distributor is changing all of that:

Angel Studios, the grassroots, Utah-based company behind the first few seasons of the wildly popular TV series The Chosen, as well as box office successes such as The Shift, Cabrini, and the breakout hit Sound of Freedom.

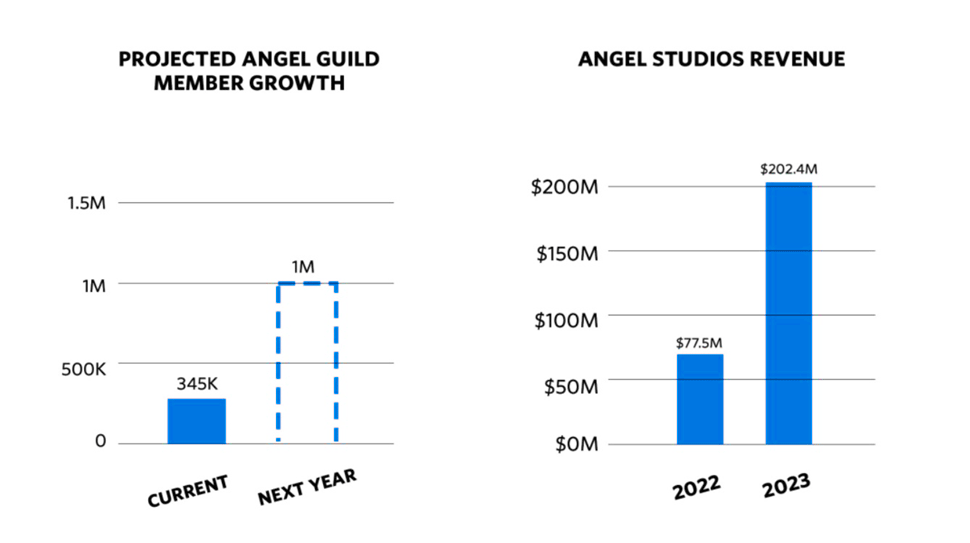

Angel Studios has begun releasing advertisements that they are looking for investors to join its “Angel Guild,” a group that currently consists of over 300,000 audience members that contribute to Angel Studios at a rate of about $20/month, in order to get sneak peeks, discounts, and vote on what films and TV shows get produced and distributed.

If that sounded unusual, that’s because it is.

“Executives have been controlling what we watch for the last 100 years,” an ad for Angel Studios new round of fundraising begins. “Only a handful of Hollywood executives… Executives have no idea what kind of content actually matters to you.”

It’s a fairly solid point. Internal politics, nepotism, vanity projects, and a too-big-to-fail studio system often produce films that no one is interested in seeing. In 2023, for example, entertainment colossus Disney severely underperformed on 7 of its 8 major theatrical releases.

In response, Angel Studios appeals to crowdfunding tactics and audience voting to align viewer demand with studio supply.

Because of the Guild, Angel Studios has reached $35 million in annual recurring revenue, and it is now offering the public a Reg A+ offering at $30.24 per share, with a minimum initial investment of $151.20. As the company itself declares, back in 2016, they were selling shares for $3, a change that shows significant growth and potential. But all may not be as it seems.

Reg A+ is a semi-difficult security to wrap your head around, so if finance is not your background or strong suit, check out this FAQ for more information on what it means for a company to distribute this kind of security. The overly simplified explanation is this – Angel Studios is not publicly traded, so your shares will have limited liquidity, but they could technically become openly traded in the future (though Angel says they have no plans to do this), and for the time being, you can share in a specified portion of the returns from individual projects Angel Studios distributes.

In the current round of fundraising, they brought in the full amount they were allowed to raise – a whopping $20M. The company touts 20% ROI on recently funded projects for investors and a revenue chart that shows $77.5M in 2022, which grew to $202.4M in 2023.

Source: https://fansinvest.angel.com/

But before we get too excited, let’s qualify those numbers, and where Angel Studios finds itself today.

In 2023, Angel Studios distributed the smash-hit “cause” film, Sound of Freedom, which made $250M at the box office. Angel Studios does not receive 100% of that money, naturally, but it does reflect a significant portion of their 2023 revenue. Studios like to post hugely successful films as indicative of future performance, but most of Angel Studios’ successful theatrical releases have made between $10M and $20M, which is still a great take for low-budget films, but it has to be kept in context. Angel is highly unlikely to repeat a success on the level of Sound of Freedom, and we are willing to bet that they left off 2024’s projected revenue from the chart for a reason: 2023 was an outlier. That doesn’t mean the company isn’t doing well, but it takes more than two years of data to show a good trend line.

Sound of Freedom was an outlier in more ways than one, however. It had a relatively modest budget, at under $15M, it was heavily wrapped up in a cause (anti-child-sex-trafficking), made use of block-ticket-buying and pay-it-forward tactics, and churches and other organizations got involved in its promotion. Sound of Freedom may have been a unicorn, and expecting something from Angel to repeat the performance may be wishful thinking.

Some of Angel’s upcoming releases are riskier than Sound of Freedom, as well. The company has poured over $50 million into a 2025 animated feature film musical called David. Certainly, a high production-quality children’s film about a Bible hero would have broad appeal – but $50M is a lot of money, and an awful lot of people are going to have to turn out in order to make it work.

To make matters worse, Angel Studios has lost its rights to association and distribution for The Chosen, so that will impact their future revenue as well – another concern for investors.

Most major motion pictures give a preferred 20% return to investors, but after that, if the film is very successful, they get an additional return. This does not seem to be the case for backers of Angel Studios films. On a fundraising page, Angel boasts that it paid 20% returns to investors of Sound of Freedom – which is strange, as the film made well over 1500% of its budget.

And, if you purchased from this latest round of fundraising, the offering documents made very clear that you are not necessarily entitled to dividends when Angel turns a profit. In fact, they tell you not to expect one, as they will be reinvesting profits.

So, you can’t sell your shares, and your shares don’t make you any returns.

It may be fair to ask whether this is really an “investment” or a “donation.”

Certainly, if the day comes when Angel sells off or merges, it’s possible that this common stock could pay off in a big way, but there is nothing so far to indicate that something like that is ever likely to happen. It can be argued, as well, that the recent fundraising materials from Angel have been somewhat deceptive to their target audience. It sure seems like this is a money-making opportunity, until you scroll way, way down and read the tiny, italicized print, or click through all of the FAQs, or read the fundraising documents. Certainly, serious investors will do this, but the average Angel Studios fan might not. Many of the comments on Angel’s social media fundraising ads seem to indicate that people are donating their money thinking they will see a return.

From an investment standpoint, it may be a reasonably good bet to invest in a particular film from Angel, but if you’re looking for a reliable ROI, you might want to look elsewhere – and don’t forget to read the fine print.

Sent to Win does not give financial advice. This article does not constitute financial advice, and it is for entertainment purposes only. For financial advice, consult with a licensed, certified professional.

Fun Fact

(In Partnership with Fidelitas)

Did you know the brains behind Sent To Win run a full-service marketing and PR agency? If you need help scaling your business profitably, you need to connect with Fidelitas.

Fidelitas has been helping small businesses, churches, non-profits, publicly traded companies, and even professional sports teams win for over 16 years. Fidelitas leads by serving as a Strategic Partner and prides itself on producing measurable results for its clients.

Check them out here or email Tyler@Fidelitas.co to connect directly with the CEO.

INDUSTRY INSIGHTS

Football Season, Market Watch, and Christian Orgs Sue IRS

Football Season

The NFL regular season officially began on Thursday, with the Baltimore Ravens clashing with the Kansas City Chiefs, kicking off an ever more ambitious economic agenda. The NFL’s 32 teams generated a combined $20 billion last year, more than the entire MLB, and they have plans to grow those numbers. Well-recognized as a uniquely American sport, the NFL has been trying to grow its appeal among international audiences for a while now, perhaps jealous of the billions generated by the soccer market in Europe and around the world. The NFL has dipped its toes in exhibition games abroad before, but this year they have committed to six regular-season NFL football games in international cities. The NFL will be visiting Sao Paulo, Brazil, London, United Kingdom, Munich, Germany, and Madrid, Spain, in an effort to expand the popularity of the sport.

Market Watch

The stock market rebounded early this week after heavy losses late last week, driving the major indices to near-record levels once again. Strong signals of a long-awaited rate cut seem to indicate that the Fed will finally cut rates at least 25 basis points, and perhaps even 50, as Powell says “the time has come” to start changing our current monetary policy. In crypto, Bitcoin ETFs experienced massive outflows, leading to a stark decline in price, before rallying somewhat early this week. Despite the volatility, savvy BTC traders and institutional traders have done quite well over the last few years, so we will see if the ETFs recover over the next few months or continue to cool down. Gold, also, experienced a decline last week but is in a recovery, still pushing near record highs. 30-year fixed mortgage rates continue to fall, drawing ever-closer to 6% as of the beginning of this week.

Christian Orgs Sue IRS

A group of Christian broadcasters are suing the IRS over the “Johnson Amendment” – a tax law that prevents non-profits from endorsing or opposing political candidates. The argument says that since certain newspapers, such as the Philadelphia Inquirer, now operate as non-profits yet are allowed to endorse candidates, churches and religious organizations should be allowed to, too. Despite the Trump Administration’s efforts to repeal the Johnson Amendment back in 2016-2017, it remains in effect. Some have pointed out that the IRS usually looks the other way, and that in fact, churches regularly violate the Johnson Amendment. The organizations suing the IRS do not want to operate outside of the law and therefore under fear of prosecution, even if the rule is not always enforced. Many religious organizations have expressed disagreement with the Johnson Amendment, but for the average American, the overwhelming majority seems to be in favor of it, preferring not to have politics enter into their time of worship.

Sunday School

Q. Ancient Christian art associated a different creature with each of the four gospels. Do you know what they are?

A. Matthew is represented by an angel, because his gospel emphasizes Christ’s humanity. Mark is represented by a lion, because it emphasizes Christ’s kingship. Luke is represented by an ox, because it emphasizes Christ’s sacrifice. John is represented by an eagle, because his gospel “sees from above.” For more background information on the tetramorph (these four symbols), check out this article.

“While I think we can all agree that you gave a very compelling presentation, it is still the unanimous opinion of this board that the magic beans are a bad investment.”

TIPS & TRICKS

How to Build an Advisory Board

It’s no great shock to say that no one can be an expert in everything. But for some reason, as highly competitive entrepreneurs, sometimes we can feel like we aren’t allowed to ask for help. Or, for some, they don’t feel like they have a ready source of information and experience near at hand when it is needed. For whatever reason, the urge to do it all on our own can be very strong.

What can help overcome the awkwardness, uncertainty, and indecision of trying to find answers outside of your expertise is simply having a structure. If you haven’t done so already, build an advisory board. Far from being an imposition, if you ask the right people, they may even feel honored that you asked. This way, not only do you have access to filling in the gaps in your expertise and gaining wisdom before making big decisions – you also have a group of people that you respect who expect you to give a report and will keep you accountable.

Here’s how to set up an advisory board.

Make a List of Potential Members

Whatever business you are in, we highly recommend that your advisory board includes:

- A Lawyer: Even if you think you don’t need a lawyer, you do. Lawyers are trained to think differently than the rest of us, and it’s always worth having that perspective on the team.

- A Banker: Much of business includes raising capital and safely investing profits. A banker’s perspective is invaluable.

- A Mentor: Someone who knows you and is able to address the mental aspect of business or the spiritual side of your life can be a great asset to your advisory board. This person will bring a deeper understanding of you as a person to the table, and they may be able to save you a lot of trouble by knowing your history, strengths, and weaknesses.

Beyond these three areas of expertise, it is worthwhile asking yourself what other areas of expertise are relevant and finding two to five additional individuals to sit on your advisory board. Sometimes a retired individual from your same industry is a good person to have on the advisory board, because they are no longer in competition with you, but they understand the particulars of your business. Sometimes a niche subject-matter expert is worth having onboard, or in many cases a broader skill set is helpful. Consider an accountant, a consultant, a marketer, a fundraiser, a veteran… whoever will bring a helpful perspective to the conversation.

Once you know what kind of people you need on your board, write down a few names for each skill, and then reach out.

How to Reach Out

When asking someone to be part of your advisory team, remember to be respectful, specific, and appreciative.

Whether you have a phone call or write an email, begin by telling this person how much you respect them in their field, and why you value their perspective.

Tell this person that you are reaching out because you’d like to have him or her on your advisory board. Then, tell them how often this advisory board will meet, what would be needed from that person if he or she joins, and the extent of the commitment. People worth talking to in business are usually fairly busy. Even if they like you a great deal, they still need to know how to fit your advisory meetings into their schedules. Don’t waffle or get flimsy. Know what you are asking and ask for it specifically. Keep in mind that an advisory board does not usually need to meet more than once a quarter or twice a year.

Be sure to thank the person you are speaking to, whether they can accommodate your request, and do not take it for granted that they can be on your advisory board. Come across as confident yet humble. Nothing irks a successful professional more than an entitled attitude toward their services, so make sure they feel appreciated.

How to Run a Meeting

You’ll have to put some thought into how you’d like your advisory board meetings to go, but here are a few tips:

Schedule meetings far in advance. Getting several busy people in the same place at the same time, or even on the same Zoom call at the same time, can be a challenge. Start planning well ahead of time, and schedule out several meetings at once.

Have something to report at each meeting. This will look different from business to business, depending on where you need advice and accountability, but think of some key metrics you can report on every time you get together. Additionally, have a report to follow up on the previous meeting so that you can inform the advisory board of the steps you’ve taken since you were last together. Once you have given your presentation, it is helpful to inform the members of the advisory board what you need their perspective on. Be specific, if you can. Let them talk, and try not to interrupt. Have someone take notes.

Then, when the meeting is winding down, always ask, “What am I not asking? What do I need to hear?”

No man is an island, as John Donne sagely put it four hundred years ago. It’s just as true today as it was then. Get a good group of men and women together, and lean on their experience as you grow and thrive.

Quick Hits

- Verizon will purchase Frontier Communications in an all-cash, $20B deal to expand their fiber network.

- Christian parents are concerned at the lack of protection on school-issued iPads.

- Support for a U.S. ban of TikTok falls; half of adults doubt it will actually happen.

- Chris Reed, CEO of Christian ministry MorningStar, has stepped down, as sexual misconduct surfaces.

- Apple has big plans to surge ahead: Incorporate AI into the next generation of iPhones.

For Kingdom Leaders, By Kingdom Leaders

Bringing Kingdom-minded leaders like you fresh perspectives and insights on business, finance, and leadership trends.