Key Changes to the Tax Code: 2024 and Beyond

“Your last two comment cards have said, ‘Did Jesus mean render unto to Caesar every year?’ and ‘If God owns everything, can I list Jesus as the owner of my sole proprietorship to alleviate my tax burden?’ I’m a little worried, Hal.”

Key Changes to the Tax Code: 2024 and Beyond

Discussing tax policy isn’t exactly the most riveting issue for most people, but for business owners, operators, and entrepreneurs, knowing the rules is key to winning the game. In this brief article, we’ll make you aware of some good things that are happening for taxes this year and some critical policies that may sunset after next year. Plan accordingly.

Changes for 2024

As your local H&R Block is in a frenzy prepping tax returns for the tax year 2023, we ought to have our eyes on next year’s taxes (and perhaps the next one or two years after that) so that we act in our best interests right now. Here are some key stats and facts for this year.

- Businesses only have until April of this year to claim their COVID-era Employee Retention credit.

- The standard deduction for married couples filing jointly is increasing by $1,500 to a total of $29,200.

- The standard deduction for single taxpayers is rising $750 to $14,600.

- The IRA contribution limit and the 401(k) contribution limits have both risen $500, respectively

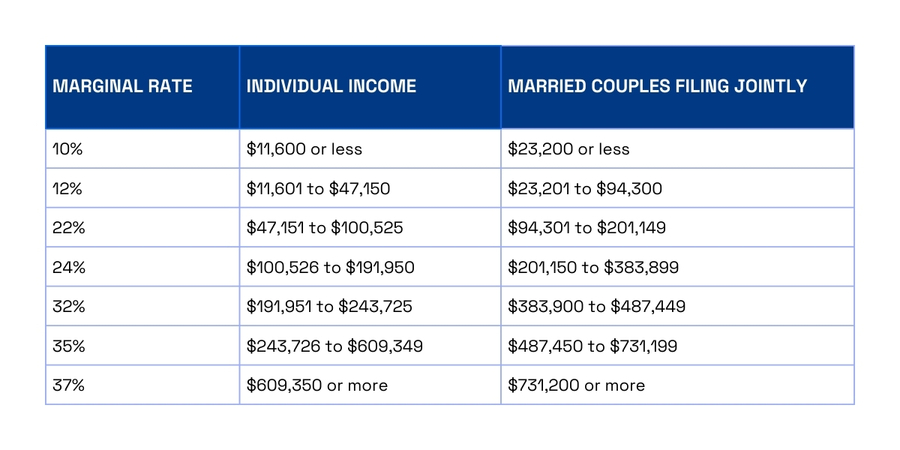

- New tax brackets have gone into effect to account for inflation:

Changes for 2025 and Onward

The Supreme Court recently heard arguments in Moore v. U.S. on the question, “Are unrealized gains income and therefore taxable, in regards to the 16th Amendment?” This decision could have far-reaching consequences for businesses, corporate shareholders, and private investors. The court is relatively conservative at the moment, and a large uproar from the tax watchdog community that resulted in amicus filings may prove that this case does not cause needless upheaval in American business affairs. However, keep an eye on this ruling, which will likely be released in June or July of this year.

Here are a couple of other things to keep an eye on in 2025 and onward:

- Some business-friendly provisions of the Tax Cuts and Jobs Acts are set to end at the close of 2025, including the 199A Pass-Through Provision, which allowed households running a business not subject to the corporate income tax to deduct a large portion of its revenue.

- Unless Congress renews popular tax cuts, after 2025, the standard deduction will be cut in half, the Child Tax Credit will disappear, and the cap on the SALT deduction will end.

- Individual tax rates will return to the (less-favorable) 2017 brackets.

- A looming debt crisis could cause Congress to look for ways to increase tax revenue.

- Anything could happen between now and then, but if the timeless parable of the ant and the grasshopper has taught us anything, it’s that it’s good to be the ant because winter will eventually come. As Howard Gleckman of the Tax Policy Center says of 2026 and beyond: “Buckle up.”

None of this should be construed as financial advice. For entertainment purposes only.

Quick Hits

- Elon Musk’s company Neuralink announces its first successful chip implantation in the brain of a human subject.

- Amazon Prime Video joins Netflix, Disney+, Paramount+, Peacock, and Hulu with an ad-supported experience for basic-level paid subscribers, continuing the shift away from ad-free streaming.

- ACE Scholarships, an education non-profit, reports a tripling of school choice scholarship requests since COVID.

- A Harvard study reveals that half of U.S. adults cannot afford to pay rent. 25% of U.S. adults are “moderately cost-burdened,” spending 30-50% of their income on rent + utilities, and another 25% of U.S. adults are “severely cost-burdened,” spending more than 50% of their income on rent + utilities.

- Sarah Zylstra of The Gospel Coalition chronicles the dizzying speed at which Quebec secularized and how the few Christians that remain today are working to evangelize North America’s largest unreached people group: French Canadians.

For Kingdom Leaders, By Kingdom Leaders

Bringing Kingdom-minded leaders like you fresh perspectives and insights on business, finance, and leadership trends.