More Faith, Less Fear, No Franchises: The Inspirational Life and Career of In-N-Out CEO Lynsi Snyder

In today’s newsletter:

- More Faith, Less Fear, No Franchises: The Inspirational Life and Career of In-N-Out CEO Lynsi Snyder

- Making Waves in the Market, Institutional Trust, and Super Bowl Sunday

- Key Changes to the Tax Code: 2024 and Beyond

What would you say to a 17-year-old who just became the sole heiress of a multi-billion dollar fast-food enterprise that would one day soon need her to run it? If you said, “God help you,” that isn’t much different than what Lynsi Snyder, president and CEO of In-N-Out Burger, said to herself at the time. And looking back now, Lynsi will tell you that’s exactly what He did.

How It All Started

Harry and Esther Snyder, Lynsi’s grandparents, started In-N-Out in 1948 in Baldwin Hills, California, as the state’s first drive-thru hamburger stand. Later that year, the stand was equipped with one of the first two-way speaker boxes to be used in the food service industry. They grew and expanded, known for their family atmosphere, cheerful service, and a no-nonsense menu that prioritized freshness and quality ingredients. Freezers, microwaves, and heat lamps were banned from all In-N-Out locations, and Esther Snyder continued to hand shape each and every patty for the chain’s 5 locations until 1963 when they opened a meat processing facility.

Harry Snyder passed away in 1976 at the age of 63, and leadership of the company passed to his sons, Rich and Guy, as President and Vice President, respectively. Esther, his widow, continued to lead the company as well. Rich was the first to begin placing Bible verses on the In-N-Out paper cups shortly after becoming a born-again Christian. He had the words “John 3:16” printed ever-so-subtly on the bottom of their cups for those who happened to look. He passed away in a tragic plane crash in 1993 after 17 years as president. His brother Guy (Lynsi’s father) took the reins until 1999 when he also met an untimely death.

Lynsi “had other plans” regarding what she was going to do with her life. But when her father passed away, she was the only surviving Snyder, aside from her aging grandmother, so she decided to rise to the occasion.

Core Principles: Faithfulness

Lynsi’s upbringing was not always easy. Yes, her family had some wealth, but her father struggled with chronic pain, which led to alcoholism and drug addiction. Her father had to spend time in rehab, and he eventually committed an affair, and Lynsi had to watch her parents go through a divorce. She would live to see her dad divorce again, which, coupled with the loss of her uncle and father, robbed her of the stability she needed to feel secure.

Lynsi has told her story in full in a wonderful mini-documentary that you can watch here, but to sum it up, she ran from one bad relationship to another, was first divorced in her early twenties, became involved in drugs and alcohol, and then went through two more divorces.

“After my dad died, there was no way I was going to be alone,” she says. “He’s gone, so I had even greater reason to fill the void.” There were a lot of years of personal struggle, but she eventually came to a place where she saw that God had better things for her than a string of broken relationships, self-loathing, and shame. “God took me to a place I’d never been before, and he showed me that in that time where I felt more alone than ever, more of a piece of trash than ever, more of a failure, that He was there, and He was ready to love me and fill that void.”

Her faith journey intersects in such a fascinating way with her career trajectory. When only 17 years old, she knew that more was going to be required of her than she could, at the time, fulfill. So she dutifully took a service job in the restaurant chain that she owned and scrubbed vegetables. Then, she went into the corporate office and studied the business, rotating among its various departments so that she could achieve real organizational fluency. She did this because she loved her grandparents, what they stood for, and what they had built. She saw herself as a “protector” and a “defender” of that legacy. Even though she hadn’t envisioned this life for herself, she walked the path the best way she knew how, and the results have been spectacular.

Likewise, in her personal journeying, she knew that there was a God who loved her. She wasn’t always close to Him, but she never forgot that He was there. Slowly, step by step, as her life progressed, she sought after Him, made changes in her life, and reveled in the idea of serving the kingdom of heaven. “The creator of the universe being able to use you is like… Whew!” She laughs then and smiles a winning smile.

Identity and Lessons Learned

In-N-Out is a delightful paradox of innovation and expansion tempered by rigid adherence to company tradition and conservative business practices. Lynsi Snyder is a thrice-divorced, former drug and alcohol abuser who has been happily married for the past ten years, a proud mother of 4, and was at one time America’s youngest female billionaire.

She and In-N-Out are similar in many ways. She knows what she stands for, and she doesn’t make a big fuss about it – but neither is she going to compromise on what got her to where she is today. In business and in food service, fads and new technology come and go, and Lynsi has been offered outrageous sums of money by investors, IPO proposals, and Saudi Princes to sell or restructure. But In-N-Out and Lynsi continue to move slowly, deliberately, and according to their core principles.

The resulting corporate culture is one that provides shockingly consistent product quality, customer experience, and a slow-but-steady, durable business model wherein the typical location outsells McDonald’s by nearly 2x. (A typical In-N-Out brings in $4.5M in revenue, compared to $2.6M for a McDonald’s.) The average manager of an In-N-Out Burger makes $180,000 per year, according to Snyder in her new book. All of their locations are owned by the company for the sake of guaranteeing quality and consistency (“Never sell and never franchise” being one of their key operating principles). They treat their people well, keep their prices low, keep their quality high, keep their offerings simple, and they expand slowly with extreme precision.

In-N-Out sells fewer than 15 things (McDonald’s, by comparison, offers well over 100). It has added an average of 5 locations for each year it has been open for business, for a total of 417 locations (compared with McDonald’s, which has over 40,000 locations currently operating, despite being seven years younger than In-N-Out). In-N-Out is debt-free, running a tremendous profit margin, and continuing to keep its head down and do consistently good business.

Lynsi is dedicated to keeping the company to its core principles, and she’s sticking to her core principles as well. She is dedicated to charity work and runs a foundation that works to end substance abuse and human trafficking. She isn’t shy when asked about her faith, but she doesn’t puff her chest out and trumpet it, either. Lynsi comes across as a humble, normal, down-to-earth person, and it’s no wonder that she consistently maintains one of the highest CEO ratings of any owner of a large company, and In-N-Out, according to GlassDoor data, is one of the best places to work.

There’s something to be said for strong core values in a business, faithfully walking out the necessary path even in times of apparent turmoil, and being humble. Business doesn’t need to be high-risk, flashy, or boastful. Slow and steady (and smart), often win the day.

It’s working for Lynsi Snyder, and it’s working for In-N-Out, too.

INDUSTRY INSIGHTS

Making Waves in the Market, Institutional Trust, and Super Bowl Sunday

Making Waves in the Market

Activist investors – subtle players in the market who typically want to drive the price of their holdings up often by forcing their companies to break up, sell, or merge – are likely to begin making moves in the tech world, according to experts. IPO valuations are rising, and with them, lucrative, if risky, opportunities for the average investor. The market would do well to keep an eye out for the signs of a bubble, however, in a time where the major trading indexes are up between 50-115% in less than five years, measured from the pre-COVID highs. After a year or so of declarations that the TINA era (which claimed there is no alternative to stocks for the average investor) is over, we can agree. Inflation has been difficult to deal with, but at various times in the recent past, government and certain corporate bonds have performed well, and the upside for current bond investors is only likely to increase if the foreseen rate cuts happen this year. (Sent to Win does not provide financial advice, and its content is for entertainment purposes only)

Institutional Trust

According to a new poll by Gallup Research, Americans trust nearly all professions less than they used to, with nurses scoring highest in perceived trustworthiness/ethics (78% trust, still a 7-point drop from 2019) and Congress coming in dead last at 6%. Pastors and clergy came in at an all-time low in the survey’s history, with only 32% calling them ethical. According to Barna Research, almost 2/3 of Americans have a very positive opinion of a pastor they know personally, but a much lower percentage trusts pastors in general. The Gospel Coalition published a list of 5 ways pastors can earn trust, but while some of the distrust is well-earned, some may be due to the historically low faith Americans currently have in institutions, nearly across the board.

Super Bowl Sunday

With their respective wins this week, the San Francisco 49ers and the Kansas City Chiefs will be facing off in what is expected to be the most-watched U.S. telecast in history on February 11th, Super Bowl Sunday. One of the factors driving interest is the tabloid romance of superstar Taylor Swift with Chiefs tight end Travis Kelce. Swift attends many of the games, and as a result, female NFL viewership is at the highest it has ever been recorded. Apex Marketing Group estimates the “Taylor Swift Effect” has added $300 million in brand value for the Kansas City Chiefs and the NFL.

This year’s contest will take place in Las Vegas, Nevada, and despite the fact that hosting a Super Bowl can potentially bring in a lot of money for the host city, Las Vegas already swells every year for Super Bowl Sunday without actually hosting the game. There’s a chance it might not make them as much money as you’d think – or it may actually cost them money. If you’d like to attend the game yourself, you’ll have to break open your piggybank because the average ticket price is currently hovering at just under $10,000 (some report an even higher figure), with the cheapest tickets available costing over $8,000 and the highest end tickets are currently going for tens of thousands of dollars. If you want to buy a box suite to watch the game, it will cost you a couple of million dollars.

Sunday School

Q. What was the name of King David’s father?

A. Jesse

“Your last two comment cards have said, ‘Did Jesus mean render unto to Caesar every year?’ and ‘If God owns everything, can I list Jesus as the owner of my sole proprietorship to alleviate my tax burden?’ I’m a little worried, Hal.”

TIPS & TRICKS

Key Changes to the Tax Code: 2024 and Beyond

Discussing tax policy isn’t exactly the most riveting issue for most people, but for business owners, operators, and entrepreneurs, knowing the rules is key to winning the game. In this brief article, we’ll make you aware of some good things that are happening for taxes this year and some critical policies that may sunset after next year. Plan accordingly.

Changes for 2024

As your local H&R Block is in a frenzy prepping tax returns for the tax year 2023, we ought to have our eyes on next year’s taxes (and perhaps the next one or two years after that) so that we act in our best interests right now. Here are some key stats and facts for this year.

- Businesses only have until April of this year to claim their COVID-era Employee Retention credit.

- The standard deduction for married couples filing jointly is increasing by $1,500 to a total of $29,200.

- The standard deduction for single taxpayers is rising $750 to $14,600.

- The IRA contribution limit and the 401(k) contribution limits have both risen $500, respectively

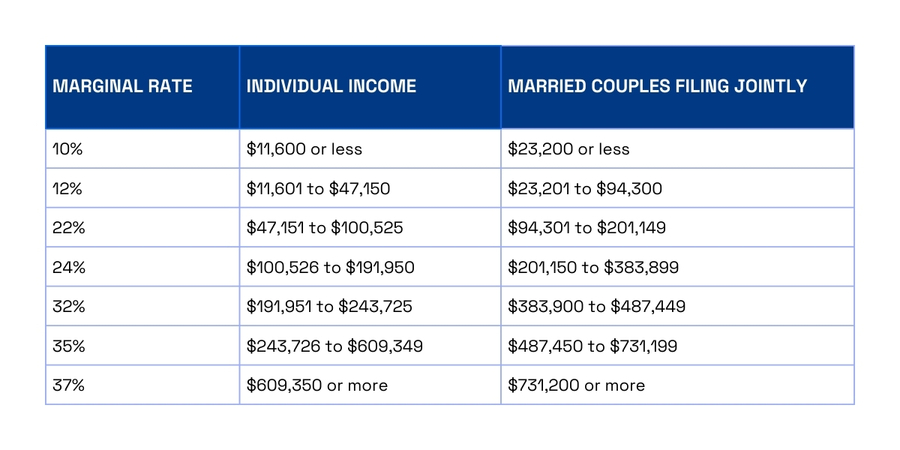

- New tax brackets have gone into effect to account for inflation:

Changes for 2025 and Onward

The Supreme Court recently heard arguments in Moore v. U.S. on the question, “Are unrealized gains income and therefore taxable, in regards to the 16th Amendment?” This decision could have far-reaching consequences for businesses, corporate shareholders, and private investors. The court is relatively conservative at the moment, and a large uproar from the tax watchdog community that resulted in amicus filings may prove that this case does not cause needless upheaval in American business affairs. However, keep an eye on this ruling, which will likely be released in June or July of this year.

Here are a couple of other things to keep an eye on in 2025 and onward:

- Some business-friendly provisions of the Tax Cuts and Jobs Acts are set to end at the close of 2025, including the 199A Pass-Through Provision, which allowed households running a business not subject to the corporate income tax to deduct a large portion of its revenue.

- Unless Congress renews popular tax cuts, after 2025, the standard deduction will be cut in half, the Child Tax Credit will disappear, and the cap on the SALT deduction will end.

- Individual tax rates will return to the (less-favorable) 2017 brackets.

- A looming debt crisis could cause Congress to look for ways to increase tax revenue.

- Anything could happen between now and then, but if the timeless parable of the ant and the grasshopper has taught us anything, it’s that it’s good to be the ant because winter will eventually come. As Howard Gleckman of the Tax Policy Center says of 2026 and beyond: “Buckle up.”

None of this should be construed as financial advice. For entertainment purposes only.

Quick Hits

- Elon Musk’s company Neuralink announces its first successful chip implantation in the brain of a human subject.

- Amazon Prime Video joins Netflix, Disney+, Paramount+, Peacock, and Hulu with an ad-supported experience for basic-level paid subscribers, continuing the shift away from ad-free streaming.

- ACE Scholarships, an education non-profit, reports a tripling of school choice scholarship requests since COVID.

- A Harvard study reveals that half of U.S. adults cannot afford to pay rent. 25% of U.S. adults are “moderately cost-burdened,” spending 30-50% of their income on rent + utilities, and another 25% of U.S. adults are “severely cost-burdened,” spending more than 50% of their income on rent + utilities.

- Sarah Zylstra of The Gospel Coalition chronicles the dizzying speed at which Quebec secularized and how the few Christians that remain today are working to evangelize North America’s largest unreached people group: French Canadians.

Guess the Prompt

Our “More Faith, Less Fear, No Franchises” graphic was generated using AI prompts. Guess the prompt for your chance to win Sent To Win gear. Just reply to this email with your best guess.

For Kingdom Leaders, By Kingdom Leaders

Bringing Kingdom-minded leaders like you fresh perspectives and insights on business, finance, and leadership trends.