Tulipmania – Beware of Quickly Rising (and Falling) Assets

Tulipmania – Beware of Quickly Rising (and Falling) Assets

Everyone wants to pick a winning investment, that once-in-a-generation winner that explodes in value and never looks back. We look back on Apple’s jaw-dropping growth from the early 2000s until today and see how much money those lucky (or wise) investors made who invested at the right time. More recently, we see winners like Nvidia, which has seen a meteoric rise over the last few years, going from less than a dollar per share to $140 very quickly. Today, Nvidia’s market cap is around $3.3 trillion.

But even with high P/Es and a healthy dose of speculation, an Apple or an Nvidia still have some fundamentals behind them. They actually bring in a significant amount of revenue, they have stable leadership, and the market is poised for them to grow well into the future.

With exciting, dynamic, fast-growing investments, it can sometimes be tempting to forget about the fundamentals altogether and only chase the growth.

But explosive growth can be a double-edged sword.

There is a phenomenon in free markets called “Tulipmania” that we want to highlight today, just to add some caution when you are considering investing big in unusually fast-growing speculative assets – especially less-than-reputable stocks or crypto tokens.

Tulips?

In the 1600s, exotic tulips became a popular way of showing wealth in Amsterdam. It started small, but before long, a few tulips could be traded for real estate, you could swap the right kind of tulip bulb for a waterfront mansion, and in 1636, one particular kind of tulip bulb was going for 150x a craftsman’s salary.

For one flower bulb. People didn’t even plant them, at a certain point. They just traded the bulbs. Prices went up drastically on raw enthusiasm. Eventually, the middle and lower classes even got involved and started risking their assets on trading bulbs. The people sort of collectively realized how ridiculously overvalued these flowers were suddenly, and the market crashed quickly, creating a miniature financial crisis and ruining many people. It was a speculative bubble that burst in a spectacular way.

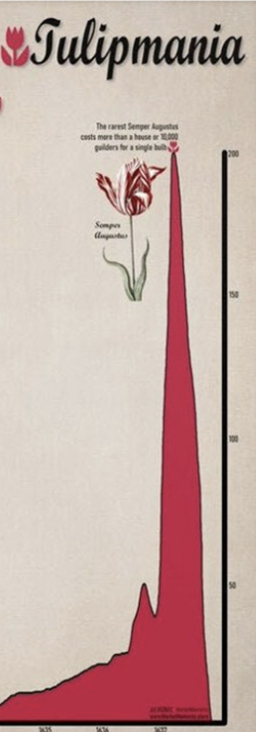

The eerie thing is, the growth curves between tulips in the 1600s and some of our fast-growing investments today look very similar. Here’s a representation of the tulip market back then:

Source: https://x.com/theoscarhoole/status/1863602566753341816

Now take a look at the growth curves for a modern meme coin. This is DOGE:

Looks amazing! $1,000 invested in Doge in the beginning of 2021 would have been worth something like $2 million just a couple of months later. However, here’s the rest of the chart:

The joyride didn’t last too long, and a lot of people lost a lot of money. It’s up again (sharply) of late because of its association with Elon Musk and the new “Department Of Government Efficiency” (D.O.G.E.). But this is driven by nothing other than name recognition, top-of-mind awareness, and greater fool theory. It will likely crash again.

There are no fundamentals in tulips or meme coins, even if the odd investor makes a killing. And keep in mind, this is steelmanning the argument. If we were to look at rug-pulls and collapsed tokens like Celsius, Sharpei, or (Lord help us) the Hawk Tuah Meme Coin, the devaluation cliff looks far worse, even though these investments were briefly shooting upward at lightning speed.

Or take the dot com bubble of a couple of decades ago – hyper-speculation on fast-growing stocks drove massive (and short-lived) gains for numerous companies that soon crashed, declared bankruptcy, or ceased to exist. Pure enthusiasm was driving prices, in a sort of mass hysteria that the market quickly corrected. Take Akamai Technologies for example:

Akamai is one of the lucky few dot-com-bubble stocks to still be around today, but even still it has taken 25 years for Akamai to recover less than ⅓ of its peak value. If you invested in the hype in 1999, you would have lost everything. It was peak Tulipmania.

Here’s the lesson: Don’t invest what you can’t afford to lose, have a healthy suspicion of sudden and overwhelming public support for an investment, and always remember that things which climb quickly tend to fall just as fast, and sometimes faster.

Growth investing is having its moment in the market, but there is a reason that Warren Buffett and his long-term strategy of value investing is so durable. Sometimes the lights that shine the brightest overheat and explode.

Sent to Win is for entertainment purposes only and should not be construed as financial advice. Sent to Win does not give financial advice. Sent to Win recommends that individuals always see a certified investing professional before making decisions on how to invest in the market.

Jakob would later come to regret trading his house for the tulip.

Quick Hits

- Greek “ghost towns” offer an eerie example of population collapse in Western countries, with dire economic consequences.

- A Washington pastor is sued for promoting a $6 million crypto Ponzi scheme to his congregation.

- Super sports agent Scott Boras secured the largest MLB contract of all time for his client Juan Soto.

- The Daystar saga continues: Jonathan and Suzie Lamb reveal evidence that the ministry had them followed, tracked, and rummaged through their things.

- Embattled Christian baker Jack Phillips, whose business has repeatedly been targeted by activists bringing lawsuits, emerges victorious yet again in a big win for religious liberty in the U.S.A.

For Kingdom Leaders, By Kingdom Leaders

Bringing Kingdom-minded leaders like you fresh perspectives and insights on business, finance, and leadership trends.